REGISTERED EDUCATION SAVINGS PLAN

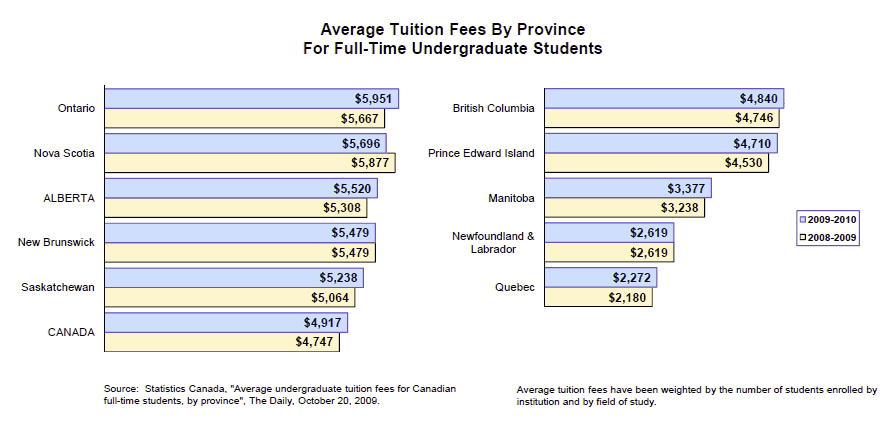

Projections indicate that in the year 2023 it will cost more than $85,000 for a 4-year university program for a student living away from home. Statistics Canada revealed that university tuition fees have risen 135% in the past ten years. University costs

Fortunately, starting to save early will allow you to accumulate enough money so that your child does not need to encounter such a huge financial burden. The Canadian Government will grant up to $500 in respect for each beneficiary ($1,000 in CESG if there is unused grant room from a previous year), and a lifetime limit of $7,200 as of 2009. This grant is called “The Canada Educations Savings Grant” or CESG paid by Human Resources and Skills Development Canada. This grant can be obtained simply by investing in an RESP or Registered Education Savings Plan. This CESG grant equals 20% of your annual contributions per year. As of 2007 there is no annual limit for contributions to RESPs. The lifetime limit on the amounts that can be contributed to all RESPs for each beneficiary is $50,000.

On January 1, 2005, the government enhanced the program for low-income families. There is now a second grant that can total up to 40% of the first $500 of contributions. An education bonus can also be paid to children born on or after January 1, 2004 and the allowable maximum over a 15-year period is $2,000. For 2009, the additional CESG rate on the first $500 contributed to an RESP for a beneficiary who is a child under 18 years of age is:

- 40% (extra 20% on the first $500) if the child's family has qualifying net income for the year of $38,832* or less; and

- 30% (extra 10% on the first $500) if the child's family has qualifying net income for the year that is more than $38,832* but is less than $77,769*

* These amounts are updated each year based on the rate of inflation.

To obtain the most current information on limits, grants, or general information on RESP's please click the following link to be redirected to the RESP section on the Revenue Canada website. RESP information

Contributions to an RESP can begin as low as $25 a month until December 31 of the year in which the beneficiary designated in the plan at issue reaches 17 years of age. Some companies will also give an additional bonus on-top of the Government’s contribution. Click here to apply for an RESP